THE 5 STEPS TO OBTAINING YOUR NIE :

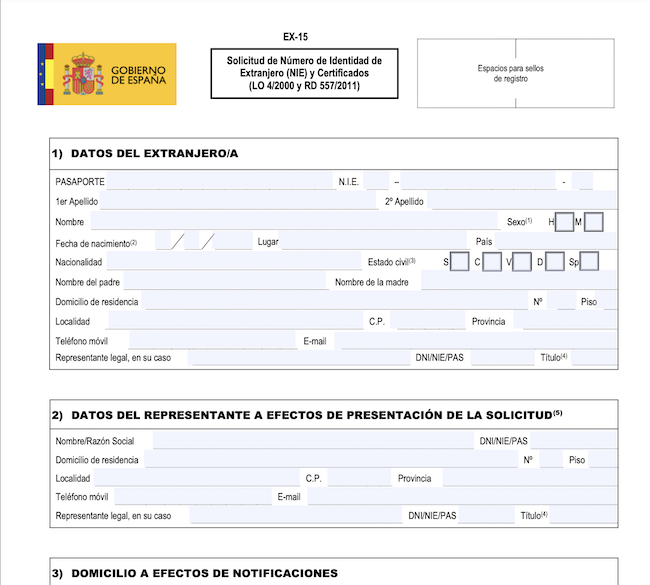

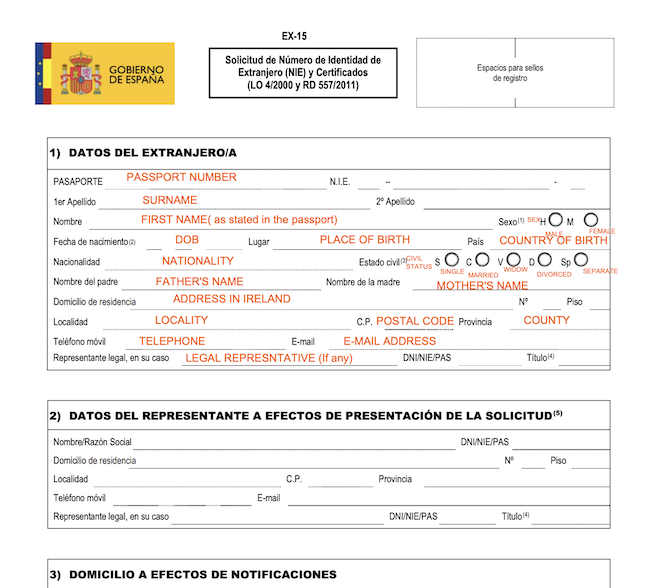

- Download and fill in the SPANISH EX-15 NIE application form. Use this English-completed EX15 as a guide to fill in the Spanish form

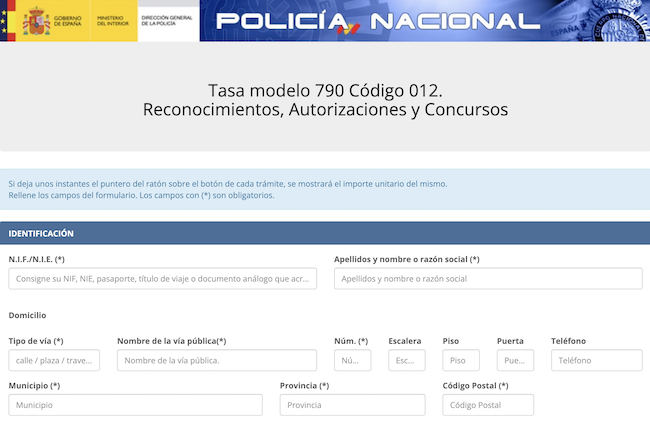

- Download and fill in the Tax Modelo 790 code 12.

- Go to an ATM and scan the barcode on the Modelo 790 form to pay the tax. (About 10 euros)

- Book an appointment at your local police station.

- Bring your NIE application form (original and a copy), the receipt from the ATM to prove you have paid the tax, your passport, and a printed copy of your passport. Finally, you should bring any documentation to prove why you want to obtain an NIE number in Spain such as a pre-work contract.

WHAT IS AN NIE NUMBER?

The NIE, known as the Número de Identificación de Extranjero, is a unique number given to you by the Spanish authorities so that you can work legally in Spain.

It is a number that helps the Spanish government track your work profile and economic activities.

Once granted your unique NIE number, any work you do in Spain, the taxes you pay, and any big assets like a home or car will all be linked to this number. You will also need an NIE number to open a bank account in Spain, change your driver’s license to a Spanish license, and register in the Spanish social security system.

WHO NEEDS TO GET AN NIE NUMBER?

The main applicants and scenarios for obtaining an NIE number include:

- Foreign Residents: Non-Spanish residents who plan to stay in Spain for over three months are typically required to obtain an NIE. This includes individuals moving to Spain for work, studies, or other long-term purposes.

- Property Transactions: If you are buying or selling property in Spain, you will likely need an NIE. This applies to both residents and non-residents.

- Opening a Bank Account: Non-residents often need an NIE to open a bank account in Spain.

- Employment: Foreigners working in Spain, whether temporarily or permanently, usually need to obtain an NIE.

- Business and Commercial Activities: Individuals engaging in business or commercial activities in Spain, including starting or representing a company.

- Legal and Administrative Procedures: An NIE is often required for various legal and administrative procedures, such as applying for certain permits or licenses.

THE STEPS TO OBTAINING YOUR NIE NUMBER

1. Download and fill in your EX-15 NIE application form.

The first thing you must do is find and fill out the NIE application form called the EX-15 NIE application form. This form can be found here.

If you don’t speak Spanish I would recommend uploading this to Google Translate and downloading the English translation. Use this as a guide as you fill the form out.

Or you can download this EX 15 guide to use as a reference as you fill out the form.

You can also follow along on our Youtube video as we fill this in!

2. Download and fill in the Tax Modelo 790 code 12.

Next, go to the following Spanish police website to fill out the tax form relating to your NIE application.

You must fill out the details on the webpage and then download the completed form and print it out.

3. Go to an ATM scan the tax Model 790 and pay the tax.

Bring the Modelo 790 that you just filled out and downloaded to a Spanish ATM. Scan the barcode and follow the instructions onscreen to pay the corresponding tax. Remember to print the receipt as proof that this tax is paid and staple it to your tax model 790

4. Book an appointment at your local police station.

Go to the following Spanish Government webpage. Accept the terms and conditions and then choose the nearest Spanish police station to you for your NIE appointment.

If you are applying from outside of Spain you can do this at your local embassy. Although it is recommended that if you are going to be in Spain shortly you should try to obtain your NIE in Spain instead.

5. Show up to your NIE appointment

When showing up to your appointment at the local police station bring the following documents

- NIE Application form

- Tax model 790 and receipt of payment

- Your passport

- A printed copy of your passport

- Any documentation showing your reason for obtaining your NIE. This could be a prework contract, a legal document showing you are about to purchase a property, a. business plan ETC.

If you have your documentation organized it is possible to get your NIE number without a translator. I have done this myself without speaking Spanish. But if you can find a translator it will make this process a lot lot smoother.

Conclusion

If you follow these simple steps getting your NIE number in Spain does not have to be a painful process.

If this is your first step in starting a business in Spain please reach out to us for a free consultation call to help you streamline your taxes, save money and time.